Unlocking Global Markets: Insights from the Latest EMDG Recipient Data

The Export Market Development Grants (EMDG) Program supports Australian SMEs by providing 50:50 matched funding for export promotion and marketing development. In the meantime, Austrade has made available the latest data from the outcomes of prior round funding (Rounds 1, 2, and 3), providing valuable insights into the profile of grant recipients and some interesting emerging export market trends. Here are the key takeaways.

Who Are the EMDG Recipients?

Over 60% of grantees report an annual turnover of under $1 million.

The majority (57%) of recipients operate with 2 to 9 employees.

Where Are They Expanding?

The majority of grantees target between 2 to 10 export markets.

USA has consistently been the main target market for grantees at 51% followed by the United Kingdom (35%), and Canada (20%).

Other key export destinations include Singapore, China, Germany, France, Japan, India, and Hong Kong.

Industries Leading the Charge

The Services and Technology sector accounts for 40.5% of grant recipients. Other top-performing industries include:

Consumer Advisory (17.3%)

Food & Agriculture (13.9%)

Advanced Manufacturing (11.2%)

Education (6.8%)

How Are Grants Being Used?

The top three categories of eligible expenditure and the percentage of grantees claiming these expenses in milestone reports are:

Promotional literature and advertising (70.8%)

Short trips to foreign countries (51.0%)

Consultants (33.0%)

Underspending is common, with a 16.8% underspend rate recorded in 2022-23. Businesses with lower turnovers (under $250,000) had the highest underspend rates.

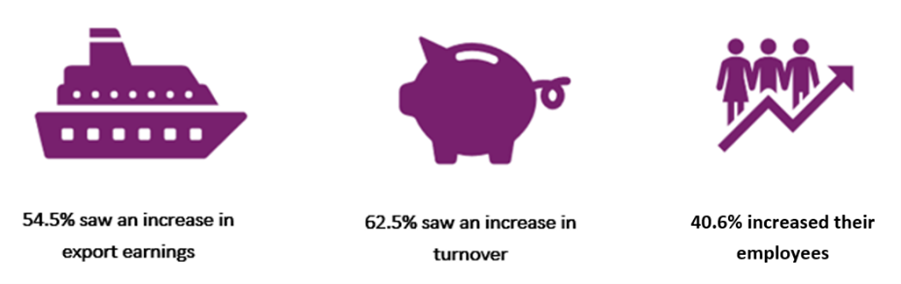

Impact on Business Growth Across the Board for the 2023-2024 Financial Year:

(Austrade, 2025)

The top 5 industries that saw an increase in export earnings, along with the proportion of grantees in each industry who achieved this, are as follows:

Tourism (77.4%)

Resources and Energy (69.6%)

Education (58.4%)

Advance Manufacturing (55.5%)

Services and Technology (55.0%).

Round 4 Update and Additional Support

The latest round of EMDG Applications (Round 4) closed in November 2024 with companies currently being notified of the outcome of their Round 4 applications. Companies with active Round 4 bids can access the status of their applications, and agreements if successful, within the EMDG live portal and should check this regularly for updates. If your application is still processing, AusTrade has confirmed that the assessment and delivery of Round 4 funds will continue uninterrupted through the current caretaker mode.

If you have received a Round 4 agreement and believe your plan to market may be affected by the recent tariffs, the EMDG program has avenues for undertaking different eligible promotional activities than originally planned. Recipients should familiarise themselves with the EMDG guidelines and milestone reporting schedules and Intellect Labs is supporting their EMDG clients through this process.

EMDG recipients and SME exporters should also keep an eye out for additional export support in response to changing global conditions; with the Labor government recently announcing a number of initiatives to assist Australian exporters including $50M for affected sectors to find new markets and up to $1bn in zero interest loans for new export opportunities.

Key Takeaways

The EMDG program continues to help Australian SMEs establish and expand in international markets. With over 9,600 grant agreements executed and a 93% success rate in securing funding, the program remains a crucial enabler of global business growth.

As businesses adapt to changing economic conditions, leveraging the EMDG effectively while ensuring compliance with expenditure requirements can be a game-changer in achieving sustained international success.

Get in touch if you’d like to understand more about the EMDG program or what other funding opportunities are aligned with your projects.