Tracking the Industry Growth Program Outcomes.

Authors: Joel Spotswood and Jacqueline Heighway.

Update 1/1/26: Since the publishing of this article, the Federal Government’s Mid-Year Economic and Fiscal Outlook (MYEFO) has revealed that $102M in uncommitted funding has been removed from the IGP, impacting FY25/26 and FY26/27 and meaning that the remaining funding pool for the program has been significantly reduced.

Funding flow, sector snapshots, and key insights from Australia’s most in-demand innovation support program.

Program Background

The Industry Growth Program (IGP) is a federal initiative designed to help Australian startups and SMEs bridge the gap between research and commercialisation and bring innovative ideas to market. Administered by the Department of Industry, Science and Resources (DISR), the program offers advisory services and matched non-repayable grant funding from $50,000 up to $5M to businesses developing new products, services, or technologies.

The IGP specifically targets projects within TRL 3 to TRL 9, which spans proof-of-concept through to commercialisation. The IGP splits funding into two streams to align support with technology maturity and risk:

1. Early-Stage Commercialisation (TRL 3–6) provides grants aimed at feasibility and prototyping stages, with grants ranging from $50K–$250K.

2. Commercialisation and Growth (TRL 4–9) funds later-stage validation, for scaling and market entry, with grants ranging from $100K–$5M.

The IGP has seen strong demand since its launch in November 2023. In September 2024, the DISR issued additional tenders to recruit more IGP advisers — an indication of application volume and program popularity [1]. In August 2025, a milestone figure of 1,000 IGP business advisory reports was achieved via the IGP Advisory Service (IGPAS) [2].

Funding Pool Progress

The IGP was announced in the 2023–24 Federal Budget with $392.4M in funding provided to be spent over 4 years [3], with $105M allocated to internal costs [4], leaving $287.4 for the project funding pool. The program remains open for applications, with rolling intakes and no fixed closing date.

As of November 2025, the Industry Growth Program has awarded 96 grants totaling $143M [5] - approximately 50% of the initial funding pool allocation (Figure 1). 68 out of the 96 grants, or 71%, have been from the Commercialisation and Growth stream, indicating a bias towards higher TRL projects (Figure 2). DISR has not publicly disclosed a fixed split of the funding pool between Early-Stage Commercialisation grants and Commercialisation and Growth grants.

Figure 1

Figure 2

The IGP has made regular announcements of grant recipients and funding amounts in tranches since the program commenced. The first awardees were announced in August 2024 and announcements have been seen in increasing frequency as the program matures – with funding announcements from DISR regarding IGP grant projects in January 2025, February 2025, August 2025, September 2025 and November 2025 [6].

Based on the increasing cadence of funding announcements, and the demand for the program, its anticipated that 90% of the initial funding outlay will be exhausted by the end of the 2025-2026 financial year (Figure 3).

Figure 3. Projected figure for 30 Jun 2026 based on linear regression fit of the preceding 3 data points.

Grant Distribution

Early-Stage Commercialisation

Early-Stage Commercialisation grants offer between $50,000 and $250,000, targeting projects at the feasibility study, proof-of-concept and prototyping stages (TRL 3–6). To date, 28 Early-Stage Commercialisation grants have been awarded, with the majority of grants (68%) between $200k and $250k, and a median grant value of $249,519 (Figure 4).

Figure 4

Key statistics

28 Early-Stage Commercialisation grants awarded.

Min: $59,500

Max: $250,000

Mean: $205,167

Median: $249,519

Commercialisation and Growth

Commercialisation and Growth grants are for innovative projects in prototyping through to market-readiness stages (TRL 4–9). These grants are higher value, between $100k and $5M, as these later stages of development, including scaling production, market expansion, and business growth, require more capital and deliver greater commercial impact. To date, 68 Commercialisation and Growth grants have been awarded, with the majority of grants (62%) below $2M, and a median grant value of $1,629,011 (Figure 5).

Figure 5

Key statistics

68 Commercialisation and Growth grants awarded.

Min: $194,548

Max: $5,000,000

Mean: $2,019,047

Median: $1,629,011

Program Target Industries

The IGP is a key delivery mechanism for the Albanese Government’s Future Made in Australia policy, providing targeted support to innovative Australian businesses aligned with National Reconstruction Fund (NRF) priority areas [11]:

- Enabling capabilities (e.g. advanced manufacturing, AI, communication, robotics, biotechnologies)

- Medical science

- Value-add in agriculture, forestry, and fisheries

- Renewables and low-emission technologies

- Defence capability

- Transport

- Value-add in resources (e.g. mining & refining minerals).

IGP grants are awarded based on eligibility and merit criteria, and there is no guidance on how or if funding is split between the priority areas.

Awardees by NRF Priority Areas*

Early-Stage Commercialisation

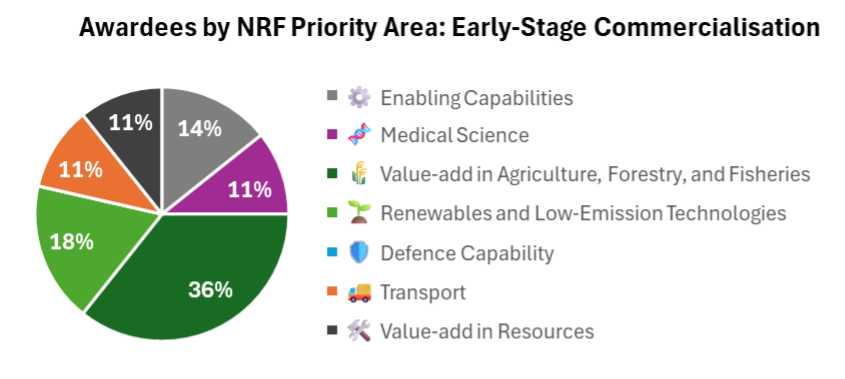

The Early-Stage Commercialisation grants have heavily favoured value-add in agriculture, forestry, and fisheries, with over one-third of all grants awarded assigned this category (Figure 6). These projects vary from lab grown meat (Magic Valley Pty Ltd, $100k), to automating berry harvesting (Forager Automation Pty Ltd, $158k), to food packaging made from banana fibre pulp waste (Papyrus Australia Ltd, $250k).

Figure 6

Commercialisation and Growth

The larger Commercialisation and Growth grants have favoured enabling capabilities and medical science NRF priority areas, together accounting for just over half of all grants awarded (Figure 7).

Enabling capabilities projects include in-flight wireless charging for drones (Aquila Space Technologies Pty Ltd, $1.8M), developing tactile sensors for robots (Contactile Pty Ltd, $269k), biomanufacturing of human lactoferrin (Eclipse Ingredients, $1.9M), and smart antennas for extending mobile and satellite coverage (Zetifi Pty Ltd, $5M).

Medical science projects include portable brain and CT scanners for first responders (EMVision Medical Devices Ltd, $5M, & Micro-X Ltd, $4.4M), an ultra-realistic non-invasive artificial larynx (Laronix Pty Ltd, $3.2M) software for ophthalmologists to prevent macular blindness (Macuject Pty Ltd, $618k), and novel biomaterials to enhance surgery and recovery outcomes (SDIP Innovations Pty Ltd, $4M).

Figure 7

Key Takeaways

The IGP is seeing strong uptake and significant demand from innovative SMEs, with over $140M (approx. 50% of available grant funding) awarded across nearly 100 grants in its first two years. 90% of the funding pool is projected to be spent by June 2026, a mere 3 years from when the first grants were awarded. That momentum reflects both the program’s broad appeal and the urgency many businesses feel to secure support for commercialisation.

If you're considering applying, it's worth noting that funding is being allocated at a steadily increasing rate and currently there is no guarantee of perpetual support or future funding allocations. The IGP does have ongoing budgeted support of $68.2 million per year [3], however we have no indication of how much of this will be put aside for future project funding or utilised internally on ongoing program administration.

The IGPAS is the required first step to engage with the program. Through this service, eligible businesses are connected with an IGP Adviser who will offer tailored business advice, culminating in the issuing of a report that may recommend you to submit an IGP grant application. The IGPAS will generally deliver confirmation of program entry within 10 working days of application, with matching to an IGP adviser typically occurring within 2–4 weeks from this date. Beyond this, timelines to business development, report generation and IGP application recommendation, submission, assessment, and outcomes can vary significantly.

In summary, the IGP is a highly accessible and useful program for both business advisory and commercialisation funding, yet one that is highly competitive with a limited funding pool and a backlog of in-process applications. If you're considering applying for the IGP, we can help you determine your eligibility and guide you through the process. Feel free to contact us at any time regarding the IGP or to explore other funding opportunities that align with your project or business.

References

[1] https://www.industry.gov.au/news/industry-growth-program-advisers-second-round-request-tender

[2] https://www.industry.gov.au/news/innovative-businesses-share-287-million-industry-growth-program

[3] https://archive.budget.gov.au/2023-24/bp2/download/bp2_2023-24.pdf (page 163)

[4] https://www.innovationaus.com/advice-admin-for-industry-growth-program-to-swallow-105m/

[5] https://business.gov.au/grants-and-programs/industry-growth-program/grant-recipients. Accessed 13 November 2025, current at 10/12/2025.

[6] https://www.industry.gov.au/news?news-topic[3310]=3310&field_news_date_value=All

[7] https://www.minister.industry.gov.au/ministers/husic/media-releases/first-funding-industry-growth-program-spans-batteries-blueberries

[8] https://www.manmonthly.com.au/400m-industry-growth-program-boosting-australian-manufacturing/

[9] https://www.intellectlabs.com.au/blogdatabase/industry-growth-program-update-032025

[10] https://www.foodanddrinkbusiness.com.au/news/latest-igp-recipients-announced

[11] https://www.nrf.gov.au/what-we-do/our-priority-areas

*NRF Priority Area categorisation of projects is based on the known industry of the awarded business and the short project summary provided, and does not reflect true internal IGP project categorisation or businesses’ or assessors’ opinions.

If you’re interested in exploring how we can help you develop your ideas and apply for SIDF funding, don’t hesitate to reach out.